Call Us: 203-701-8723 Call Us: 203-701-8723 |

Hours: Mon - Fri: 9 - 5 Hours: Mon - Fri: 9 - 5 |

1008 Main St. Branford, CT 06405 1008 Main St. Branford, CT 06405 |

Out of State Transactions

G&A SETTLEMENT SOLUTIONS

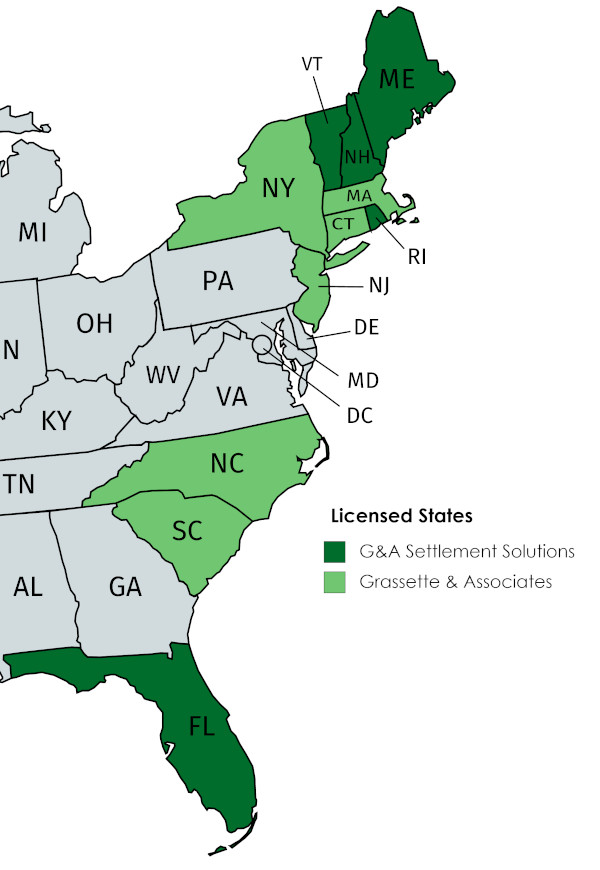

| Long ago, the Attorneys at Grassette and Associates realized the fluidity of residency in the small states of New England, as well as the tendency of many northeasterners to own vacation homes in the warmer southern climates of the Carolinas and Florida. After years of serving clients in Connecticut, it became apparent that there was a serious need for a local real estate law firm with a regional presence and the ability to serve local property owners with properties in the major vacation destinations on the Eastern seaboard. From this acknowledgement G&A Settlement Solutions was born. G&A Settlement Solutions is a fully attorney-owned title company dedicated to providing exceptional customer service with an unparalleled willingness to go the extra mile to get the transaction closed--no matter where the location! Our team of dedicated staff members are able to assist with real estate closings in all of New England, the Tri-State Area, and the sunny snowbird destinations of North Carolina, South Carolina and Florida. No matter where our clients are relocating or purchasing a vacation home, we are here to assist. Due to advances in technology, we have the ability to handle most transactions remotely without the disruption associated with traveling to conduct a closing. |

|